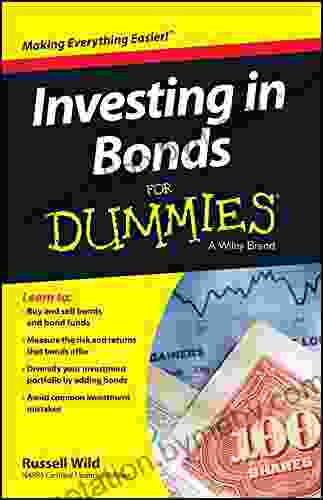

Investing In Bonds For Dummies: The Ultimate Guide to Safe and Profitable Bonds

4.4 out of 5

| Language | : | English |

| File size | : | 2995 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 268 pages |

| Lending | : | Enabled |

What are bonds?

Bonds are a type of loan that you make to a company or government. When you buy a bond, you're essentially lending the issuer of the bond your money. In return, the issuer agrees to pay you interest on your investment and repay the principal (the amount you loaned) when the bond matures.

Why invest in bonds?

There are several reasons why you might want to invest in bonds:

- Safety: Bonds are generally considered to be a safe investment, as they are backed by the full faith and credit of the issuer. This means that you are unlikely to lose money on your investment if the issuer defaults on its obligations.

- Income: Bonds pay regular interest payments, which can provide you with a steady stream of income. This can be especially helpful if you are retired or are looking for a way to supplement your income.

- Diversification: Bonds can help you diversify your investment portfolio. This means that you are not putting all of your eggs in one basket, which can reduce your overall risk.

How to invest in bonds

There are several ways to invest in bonds:

- Individual bonds: You can buy individual bonds directly from the issuer or through a broker. This gives you more control over your investment, but it can also be more expensive and time-consuming.

- Bond ETFs: Bond ETFs are a type of exchange-traded fund that invests in a basket of bonds. This gives you instant diversification and can be a more cost-effective way to invest in bonds.

- Bond mutual funds: Bond mutual funds are a type of mutual fund that invests in a portfolio of bonds. This gives you professional management and diversification, but it can also be more expensive than bond ETFs.

Choosing the right bonds

When choosing bonds, there are several factors to consider:

- Issuer: The issuer of the bond is the company or government that is borrowing your money. It is important to research the issuer's financial health and creditworthiness before you invest.

- Maturity date: The maturity date is the date when the bond matures and you receive your principal back. Bonds can have maturities ranging from a few months to several years.

- Interest rate: The interest rate is the annual percentage of interest that you will receive on your investment. Interest rates can vary depending on the issuer, the maturity date, and the current economic conditions.

Investing In Bonds For Dummies

Investing In Bonds For Dummies is the ultimate guide to safe and profitable bonds. This comprehensive guide covers everything you need to know about bonds, from the basics to advanced strategies. With Investing In Bonds For Dummies, you will learn:

- The different types of bonds

- How to evaluate bonds

- How to build a bond portfolio

- How to manage your bond investments

Investing In Bonds For Dummies is the perfect resource for anyone who is looking to invest in bonds. Whether you are a beginner or an experienced investor, this book will help you make smart investment decisions.

Click here to buy Investing In Bonds For Dummies today!

4.4 out of 5

| Language | : | English |

| File size | : | 2995 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 268 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Paul Tobin

Paul Tobin Shannon Leparski

Shannon Leparski Harry Ritter

Harry Ritter Jona Tomke

Jona Tomke Derf Backderf

Derf Backderf Dem Mikhailov

Dem Mikhailov Rhonda V Magee

Rhonda V Magee Geoffrey Ashe

Geoffrey Ashe Don Miguel Ruiz

Don Miguel Ruiz Diet Eman

Diet Eman Sascha Alper

Sascha Alper Jaed Coffin

Jaed Coffin Jonathan Bush

Jonathan Bush Edward Niedermeyer

Edward Niedermeyer Devin Devasquez

Devin Devasquez Steven Rothfeld

Steven Rothfeld Donell Barlow

Donell Barlow Mary M Bauer

Mary M Bauer Don Keith

Don Keith Laurie Ann Thompson

Laurie Ann Thompson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Harrison BlairFollow ·17.2k

Harrison BlairFollow ·17.2k Donovan CarterFollow ·3.1k

Donovan CarterFollow ·3.1k Dwight BellFollow ·7.7k

Dwight BellFollow ·7.7k Wade CoxFollow ·4.6k

Wade CoxFollow ·4.6k Gary ReedFollow ·2k

Gary ReedFollow ·2k Elmer PowellFollow ·3.4k

Elmer PowellFollow ·3.4k Cameron ReedFollow ·12.2k

Cameron ReedFollow ·12.2k Logan CoxFollow ·19.9k

Logan CoxFollow ·19.9k

Cruz Simmons

Cruz SimmonsGuide To Pencak Silat Kuntao And Traditional Weapons:...

Immerse yourself in the captivating world of...

Dalton Foster

Dalton FosterUnlock Your Financial Freedom: Dive into the ABCs of Real...

Are you ready to embark on a...

George Orwell

George OrwellThe Advanced Guide to Real Estate Investing: Your...

Are you ready to embark on...

Will Ward

Will WardMargaret Laurence: The Making of a Writer

Margaret Laurence (1926-1987) was one of...

Jorge Amado

Jorge AmadoThe ABCs of Property Management: A Comprehensive Guide...

Owning and managing rental...

4.4 out of 5

| Language | : | English |

| File size | : | 2995 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 268 pages |

| Lending | : | Enabled |