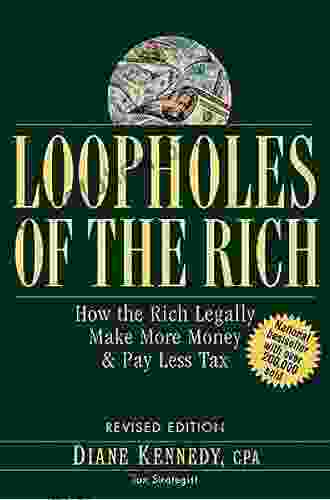

Loopholes of the Rich: Unlocking the Secrets of Wealth Accumulation

In a world where economic inequality continues to widen, the privileged few have mastered the art of amassing and preserving wealth. Their secret? Exploiting loopholes in the tax code and employing sophisticated financial strategies that are often hidden from ordinary citizens.

4.3 out of 5

| Language | : | English |

| File size | : | 7494 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 397 pages |

| Lending | : | Enabled |

The Anatomy of Tax Avoidance

Tax avoidance, while legal, involves minimizing tax liability through legal loopholes rather than illegal means. 'Loopholes of the Rich' exposes the intricate web of tax avoidance strategies employed by the wealthy.

- Offshore Accounts: Hiding assets in overseas banks provides anonymity and reduces tax exposure.

- Shell Companies: Creating multiple layers of corporate entities allows for tax optimization and asset protection.

- Tax Havens: Establishing businesses in countries with low or no corporate taxes further reduces tax liability.

- Pass-Through Entities: Using entities that pass income directly to owners avoids corporate taxes and shields assets from taxation.

The Sophisticated World of Investments

Beyond tax avoidance, the wealthy utilize complex investment strategies to grow their wealth exponentially.

- Private Equity: Investing in non-publicly traded companies offers high-growth potential and tax benefits.

- Hedge Funds: Employing sophisticated trading strategies and utilizing leverage, hedge funds aim for superior returns.

- Venture Capital: Investing in early-stage startups provides access to high-return potential and tax incentives.

- Real Estate Investments: Owning properties generates passive income, tax deductions, and potential appreciation.

The Ethics of Wealth Accumulation

While loopholes and investment strategies are legal, the ethical implications of such practices raise questions. 'Loopholes of the Rich' examines the debate surrounding:

- Fairness and Equity: Are the wealthy unfairly benefiting from loopholes that ordinary citizens cannot access?

- Fiscal Responsibility: Do loopholes and tax avoidance contribute to government deficits?

- Social Justice: Should the wealthy be held responsible for their fair share of society's needs?

Empowering the Average Investor

While the strategies used by the wealthy may seem inaccessible, 'Loopholes of the Rich' provides insights into how ordinary investors can make informed financial decisions.

- Understanding Tax Laws: Familiarizing oneself with tax laws can help individuals minimize their tax burden legally.

- Exploring Investment Options: Researching different investment strategies can lead to informed decisions and potential wealth growth.

- Seeking Professional Advice: Consulting with financial advisors can provide personalized guidance and access to sophisticated investment opportunities.

The book 'Loopholes of the Rich' offers a comprehensive examination of the financial strategies employed by the wealthy to minimize taxes and accumulate wealth. By shedding light on the complexities of tax avoidance and investment, the book empowers readers to make informed financial decisions and advocate for fair and equitable tax policies.

Whether you aspire to understand the world of the ultra-rich or simply want to improve your own financial literacy, 'Loopholes of the Rich' is an indispensable guide to navigating the complexities of modern wealth management.

4.3 out of 5

| Language | : | English |

| File size | : | 7494 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 397 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia J L Heilbron

J L Heilbron Dominique Mondesir

Dominique Mondesir Dick Van Dyke

Dick Van Dyke Dick Wolfsie

Dick Wolfsie Debraj Ray

Debraj Ray Tanya Angelova

Tanya Angelova Lukas Ritter

Lukas Ritter Ronald T Kneusel

Ronald T Kneusel Xavier Wells

Xavier Wells Diane Tuckman

Diane Tuckman Frank Langfitt

Frank Langfitt Dmv Test Bank

Dmv Test Bank Robert Edward Grant

Robert Edward Grant Don Greene

Don Greene Deirdre V Lovecky

Deirdre V Lovecky Doc Hendley

Doc Hendley Michael Mcinnis

Michael Mcinnis Graham Norton

Graham Norton Steven Rothfeld

Steven Rothfeld Gary R Walden

Gary R Walden

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Kenneth ParkerJourney Through Time: From Xenophon to Cryptocurrency - 250 Milestones in...

Kenneth ParkerJourney Through Time: From Xenophon to Cryptocurrency - 250 Milestones in... Stephen FosterFollow ·15.3k

Stephen FosterFollow ·15.3k Roberto BolañoFollow ·19.6k

Roberto BolañoFollow ·19.6k Anthony BurgessFollow ·14k

Anthony BurgessFollow ·14k Robert ReedFollow ·3.5k

Robert ReedFollow ·3.5k Gary ReedFollow ·2k

Gary ReedFollow ·2k Marc FosterFollow ·3.9k

Marc FosterFollow ·3.9k Danny SimmonsFollow ·17.7k

Danny SimmonsFollow ·17.7k Rubén DaríoFollow ·13.6k

Rubén DaríoFollow ·13.6k

Cruz Simmons

Cruz SimmonsGuide To Pencak Silat Kuntao And Traditional Weapons:...

Immerse yourself in the captivating world of...

Dalton Foster

Dalton FosterUnlock Your Financial Freedom: Dive into the ABCs of Real...

Are you ready to embark on a...

George Orwell

George OrwellThe Advanced Guide to Real Estate Investing: Your...

Are you ready to embark on...

Will Ward

Will WardMargaret Laurence: The Making of a Writer

Margaret Laurence (1926-1987) was one of...

Jorge Amado

Jorge AmadoThe ABCs of Property Management: A Comprehensive Guide...

Owning and managing rental...

4.3 out of 5

| Language | : | English |

| File size | : | 7494 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 397 pages |

| Lending | : | Enabled |