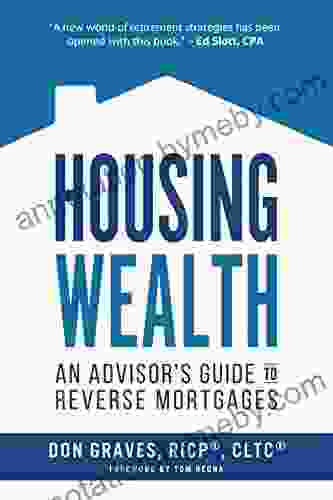

Ways The New Reverse Mortgage Is Changing Retirement Income Conversations An

Unlocking Home Equity for a Secure Retirement

The concept of a Reverse Mortgage has been revolutionized, unlocking unprecedented opportunities for seniors to enhance their retirement income. Unlike traditional mortgages, which require monthly payments, a Reverse Mortgage allows homeowners aged 62 or older to borrow against the equity in their homes without having to make monthly payments. This innovative financial tool empowers seniors to access their home's value now, providing them with financial flexibility and peace of mind.

4.7 out of 5

| Language | : | English |

| File size | : | 17006 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 194 pages |

| Lending | : | Enabled |

How the Reverse Mortgage Works

A Reverse Mortgage is a non-recourse loan secured by your home. This means that you do not have to repay the loan as long as you live in the home. The loan is repaid when you sell the home, move out, or pass away. The loan proceeds can be used for a variety of purposes, including:

- Supplementing retirement income

- Paying off debt

- Funding medical expenses

- Making home improvements

- Covering unexpected expenses

The amount of money you can borrow with a Reverse Mortgage depends on several factors, including your age, the value of your home, and the interest rate. It is important to consult with a qualified financial advisor to determine if a Reverse Mortgage is right for you.

Benefits of a Reverse Mortgage

There are numerous benefits to obtaining a Reverse Mortgage. Some of the key benefits include:

- No monthly mortgage payments: This eliminates the financial burden of monthly mortgage payments, freeing up cash flow for other expenses.

- Increased cash flow: The proceeds from a Reverse Mortgage can provide seniors with a much-needed boost to their retirement income, allowing them to live more comfortably.

- Tax-free proceeds: The loan proceeds from a Reverse Mortgage are not taxed, providing seniors with additional tax savings.

- Protection against home value declines: Unlike a traditional mortgage, a Reverse Mortgage does not require monthly payments. This means that seniors are protected if the value of their home declines.

- Peace of mind: A Reverse Mortgage can provide seniors with peace of mind, knowing that they have a financial safety net to help them through retirement.

Considerations for a Reverse Mortgage

While a Reverse Mortgage can be a valuable financial tool, there are also some considerations to keep in mind. These include:

- Loan fees: There are closing costs and other fees associated with obtaining a Reverse Mortgage.

- Interest accrues: The interest on a Reverse Mortgage accrues over time, which can reduce the amount of equity you have in your home.

- Repayment obligation: You are obligated to repay the loan when you sell the home, move out, or pass away.

It is important to weigh the benefits and considerations of a Reverse Mortgage carefully before making a decision. It is also important to consult with a qualified financial advisor to ensure that a Reverse Mortgage is right for you.

The New Reverse Mortgage is a powerful financial tool that can help seniors unlock the equity in their homes to enhance their retirement income. By providing financial flexibility, peace of mind, and tax savings, a Reverse Mortgage can empower seniors to live a more secure and comfortable retirement.

If you are a homeowner aged 62 or older, I encourage you to explore the benefits of a Reverse Mortgage. It could be the key to unlocking the financial freedom you deserve.

4.7 out of 5

| Language | : | English |

| File size | : | 17006 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 194 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia J T R Brown

J T R Brown Jane Butel

Jane Butel Michael Audain

Michael Audain Finley Aaron

Finley Aaron Direct Hits

Direct Hits Grant Cardone

Grant Cardone Xavier Wells

Xavier Wells Helena Hunt

Helena Hunt Derald Wing Sue

Derald Wing Sue Erin Entrada Kelly

Erin Entrada Kelly Emily Eliza Scott

Emily Eliza Scott Joe Kelsey

Joe Kelsey Didier Eribon

Didier Eribon Diane Greenberg

Diane Greenberg Richard Pikesley

Richard Pikesley Devika Joglekar

Devika Joglekar Nicolas Rothwell

Nicolas Rothwell Keith Elliot Greenberg

Keith Elliot Greenberg Dirk Philipsen

Dirk Philipsen Diego Footer

Diego Footer

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Marc FosterSealed Mysteries: An Extraordinary Odyssey Unveiling the Secrets of the Seven...

Marc FosterSealed Mysteries: An Extraordinary Odyssey Unveiling the Secrets of the Seven...

Orson Scott CardUnlock the Secrets to Real Estate Success: "How to Make Millions in Real...

Orson Scott CardUnlock the Secrets to Real Estate Success: "How to Make Millions in Real... Dan HendersonFollow ·8.2k

Dan HendersonFollow ·8.2k Gary CoxFollow ·9.7k

Gary CoxFollow ·9.7k Owen SimmonsFollow ·18.7k

Owen SimmonsFollow ·18.7k Matt ReedFollow ·13.9k

Matt ReedFollow ·13.9k Eli BlairFollow ·18.8k

Eli BlairFollow ·18.8k Franklin BellFollow ·6.7k

Franklin BellFollow ·6.7k Alexandre DumasFollow ·19.6k

Alexandre DumasFollow ·19.6k Nikolai GogolFollow ·3k

Nikolai GogolFollow ·3k

Cruz Simmons

Cruz SimmonsGuide To Pencak Silat Kuntao And Traditional Weapons:...

Immerse yourself in the captivating world of...

Dalton Foster

Dalton FosterUnlock Your Financial Freedom: Dive into the ABCs of Real...

Are you ready to embark on a...

George Orwell

George OrwellThe Advanced Guide to Real Estate Investing: Your...

Are you ready to embark on...

Will Ward

Will WardMargaret Laurence: The Making of a Writer

Margaret Laurence (1926-1987) was one of...

Jorge Amado

Jorge AmadoThe ABCs of Property Management: A Comprehensive Guide...

Owning and managing rental...

4.7 out of 5

| Language | : | English |

| File size | : | 17006 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 194 pages |

| Lending | : | Enabled |