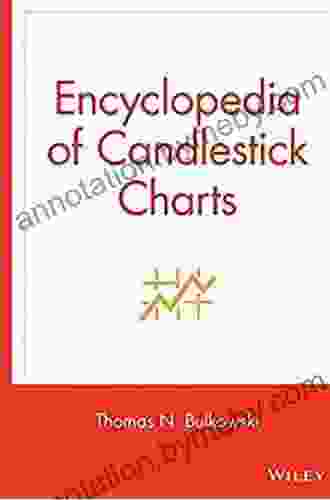

Unravel the Secrets of Technical Analysis with the Encyclopedia of Candlestick Charts

In the realm of technical analysis, candlestick charts stand as invaluable tools, offering traders and investors a visual representation of price movements that can provide essential insights into market behavior. The Encyclopedia of Candlestick Charts, published by Wiley Trading 332, is a comprehensive guide that delves into the intricacies of these powerful charting techniques. With over 200 different candlestick patterns meticulously described and illustrated, this encyclopedia empowers readers with the knowledge and understanding to make informed trading decisions.

The Encyclopedia of Candlestick Charts serves as an exhaustive compendium of candlestick patterns, categorized into three main groups: bullish, bearish, and neutral. Each pattern is accompanied by a detailed description, an illustrative chart, and an explanation of its significance in technical analysis. This user-friendly format allows readers to quickly identify and interpret candlestick patterns, even if they have limited prior experience.

Bullish candlestick patterns signal a potential increase in prices, indicating that buyers are in control of the market. Some of the most common bullish patterns include:

4.6 out of 5

| Language | : | English |

| File size | : | 70073 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1433 pages |

| Lending | : | Enabled |

- Hammer: A hammer is characterized by a small body with a long, lower shadow and a short or nonexistent upper shadow. It indicates a reversal from a downtrend and suggests that buyers are stepping in to support the price.

- Bullish Engulfing: This pattern consists of two candlesticks. The first candlestick is bearish, while the second bullish candlestick completely engulfs the body of the first. It signals a strong reversal to the upside.

- Morning Star: The morning star pattern is a three-candlestick pattern that represents a bullish reversal. It starts with a large bearish candlestick, followed by a small doji or spinning top, and then a larger bullish candlestick.

Bearish candlestick patterns indicate a potential decrease in prices, signaling that sellers are dominating the market. Some of the most prevalent bearish patterns include:

- Hanging Man: A hanging man is similar to a hammer, but with a longer upper shadow and a shorter or nonexistent lower shadow. It suggests that sellers are beginning to take control and may lead to a reversal to the downside.

- Bearish Engulfing: This pattern is the opposite of a bullish engulfing pattern. It starts with a bullish candlestick and is followed by a larger bearish candlestick that completely engulfs the body of the first. It indicates a strong reversal to the downside.

- Evening Star: The evening star pattern is a three-candlestick pattern that represents a bearish reversal. It starts with a large bullish candlestick, followed by a small doji or spinning top, and then a larger bearish candlestick.

Neutral candlestick patterns do not provide a clear indication of the direction of the market but can offer valuable insights into market sentiment. Some common neutral patterns include:

- Doji: A doji is a candlestick with an open and close price that are approximately equal. It indicates a period of indecision in the market.

- Spinning Top: A spinning top is a candlestick with a small body and long upper and lower shadows. It also suggests indecision and can precede a breakout in either direction.

- Harami: A harami consists of two candlesticks. The first candlestick is a long, bullish or bearish candle, while the second candlestick is a small candle that is completely contained within the body of the first. It suggests a temporary pause in the prevailing trend.

Beyond the basic candlestick patterns, the Encyclopedia of Candlestick Charts also delves into advanced candlestick techniques that can provide even more detailed insights into market behavior. These techniques include:

- Combining Patterns: By combining multiple candlestick patterns, traders can enhance their analysis and identify more complex market scenarios.

- Trend Analysis: Candlestick charts can be used to identify and confirm market trends, providing valuable information for long-term investment and trading strategies.

- Volume Analysis: Combining candlestick patterns with volume analysis can help traders gauge market sentiment and assess the reliability of price movements.

- Support and Resistance Levels: Candlestick patterns can be used to identify potential support and resistance levels, which can help traders determine potential entry and exit points for trades.

The Encyclopedia of Candlestick Charts is an indispensable resource for traders and investors of all levels. With its comprehensive coverage of candlestick patterns and advanced techniques, this encyclopedia empowers readers with the knowledge and tools necessary to effectively analyze market trends and make informed trading decisions. Whether you are a seasoned professional or just starting your journey in technical analysis, the Encyclopedia of Candlestick Charts is a valuable addition to your trading library.

4.6 out of 5

| Language | : | English |

| File size | : | 70073 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1433 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Tom Percival

Tom Percival Jami Attenberg

Jami Attenberg Rick Stanton

Rick Stanton Dietmar Sternad

Dietmar Sternad Diana Marie Delgado

Diana Marie Delgado Stephen J Bavolek

Stephen J Bavolek Diana Preston

Diana Preston Jennifer Selke Ramirez

Jennifer Selke Ramirez Valerie L Winslow

Valerie L Winslow Michael Freedland

Michael Freedland Jon Lymon

Jon Lymon Dirk F Moore

Dirk F Moore Elizabeth Shackelford

Elizabeth Shackelford Dominik Imseng

Dominik Imseng Youngsang Cho

Youngsang Cho Diana Murray

Diana Murray Peter Moore

Peter Moore Dervla Murphy

Dervla Murphy Kyrja

Kyrja Sujatha Lalgudi

Sujatha Lalgudi

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

William ShakespeareThe Definitive Guide to Wing Chun History and Traditions: Embracing the...

William ShakespeareThe Definitive Guide to Wing Chun History and Traditions: Embracing the...

David Foster WallaceWildwoods: Unveiling the Enchanting World of Ireland's Native Woodlands

David Foster WallaceWildwoods: Unveiling the Enchanting World of Ireland's Native Woodlands

Edward BellThe Ultimate Guide to Yoruba Tradition: Sacred Rituals, the Divine Feminine,...

Edward BellThe Ultimate Guide to Yoruba Tradition: Sacred Rituals, the Divine Feminine,... Julio Ramón RibeyroFollow ·4.2k

Julio Ramón RibeyroFollow ·4.2k Oliver FosterFollow ·16.2k

Oliver FosterFollow ·16.2k Jack LondonFollow ·5.1k

Jack LondonFollow ·5.1k Harrison BlairFollow ·17.2k

Harrison BlairFollow ·17.2k Alexandre DumasFollow ·19.6k

Alexandre DumasFollow ·19.6k Hudson HayesFollow ·13.5k

Hudson HayesFollow ·13.5k Craig CarterFollow ·15.8k

Craig CarterFollow ·15.8k Matthew WardFollow ·14.4k

Matthew WardFollow ·14.4k

Cruz Simmons

Cruz SimmonsGuide To Pencak Silat Kuntao And Traditional Weapons:...

Immerse yourself in the captivating world of...

Dalton Foster

Dalton FosterUnlock Your Financial Freedom: Dive into the ABCs of Real...

Are you ready to embark on a...

George Orwell

George OrwellThe Advanced Guide to Real Estate Investing: Your...

Are you ready to embark on...

Will Ward

Will WardMargaret Laurence: The Making of a Writer

Margaret Laurence (1926-1987) was one of...

Jorge Amado

Jorge AmadoThe ABCs of Property Management: A Comprehensive Guide...

Owning and managing rental...

4.6 out of 5

| Language | : | English |

| File size | : | 70073 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 1433 pages |

| Lending | : | Enabled |